Insurance: Buy Online or Not to Buy Online

There are a lot of ways to buy car insurance whether you're looking to buy online or from a local agent.

When shopping for car insurance there are generally three methods to buying insurance: online, exclusive agent or nonexclusive agent.

Shopping Online

Finding car insurance online gives you the most choices. You're able to shop in the comfort of your own home at your leisure and choose from a variety of companies to quote. When quoting online, you can either visit each individual company website and complete a quote form for each company, or you can use an all-inclusive quote form that quotes your information automatically with a variety of companies.

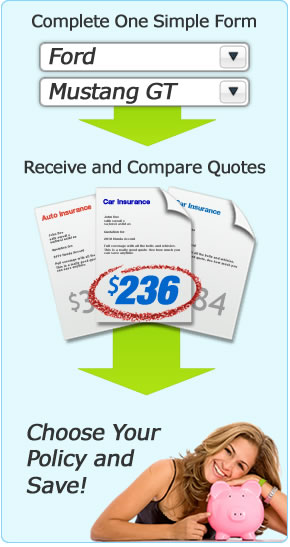

The benefits of using an all-inclusive quote form is the time saved by only having to enter your information once. Your information is shopped between competing companies and the lowest rate is returned to you. By completing the quote form at the top of this page you are able to shop multiple companies and compare rates in your area.

Exclusive Agents

Exclusive agents are those that are bound to a contract with a single company. They can only provide you the rates from one company and are not able to shop your coverages around with other companies. If you like having your insurance coverages all with the same company and often times receiving only one billing statement then and exclusive agent may be for you.

The drawback to using an exclusive agent is the lack of comparison between other companies rates. You may pay less by splitting your coverages up between multiple companies at this means having separate billing statements for each policy.

Nonexclusive Agents

Nonexclusive agents, or independent agents, can place your coverage with many different insurance companies and can compare rates to find you lower premiums. Nonexclusive agents can often be identified by having their state independent insurance agent logo or the Trusted Choice logo identified on their office.

No matter which company you choose for insurance coverage it's important to remember to choose a reputable and financially sound insurer. Be sure to ask your agent or company about any discounts that may be available such as multi-policy discounts, multi-car discounts, organizational discounts, or other ways to save on insurance.